Blogs

An individual is a full-day worker if their work schedule match the new company’s simple full-day working arrangements. Do not count the changing times your designed to hop out, but could maybe not exit, the usa because of a health condition otherwise problem one arose whilst you were in america. If or not your meant to get off the united states for the a particular go out is set according to the small print and you may points. For example, you might be in a position to expose that you designed to hop out in case your mission to possess going to the All of us would be done while in the an occasion that’s not long enough in order to qualify your on the big presence test. Don’t count the days you are in the usa at under day and you are clearly in the transportation anywhere between a couple of urban centers away from Us.

- Read Aliens Needed to Get Sailing otherwise Departure It allows, later on.

- The new filing from a questionnaire 8275 or Form 8275-R, although not, will not be managed since if this business submitted a routine UTP (Form 1120).

- For every day or fraction from thirty day period the fresh come back try late, the brand new service imposes a penalty of five percent of one’s delinquent income tax unless of course the new taxpayer can be practical reason behind later processing.

- Content Withholding – Which have particular limited exclusions, payers which might be necessary to keep back and you can remit backup withholding so you can the brand new Irs are also needed to withhold and you may remit for the FTB to the earnings acquired in order to Ca.

The fresh sailing otherwise deviation permit granted beneath the standards inside section is to your particular deviation whereby it is awarded. To locate a certificate of compliance, you must go to a TAC office at the very least 14 days before leaving the us and you will file sometimes Form 2063 otherwise Mode 1040-C and every other needed tax statements which have not become registered. The newest certification may possibly not be granted more 1 month ahead of your exit.

Bona fide Owners away from American Samoa or Puerto Rico

You are going to receive information on Form 2439, which you have to affix to the come back. For individuals who did not have a keen SSN (or ITIN) awarded to your or before deadline of your 2024 come back (in addition to extensions), you do not claim the kid taxation credit on the sometimes your brand-new or a revised tax go back. However, you’re able to claim a degree borrowing under the following the issues.

When you should document/Extremely important dates

Basically, the new teacher or teacher should be in the united states generally to coach, lecture, teach, or engage in search. A hefty part of you to person’s go out should be based on those obligations. Arthur’s income tax liability, thus, is restricted so you can $2,918, the newest income tax liability decided with the taxation treaty speed to your dividends. Their taxation responsibility is the amount of the fresh taxation on the pact money plus the income tax to your nontreaty money, however it cannot be over the brand new tax responsibility thought because the if the income tax treaty hadn’t are in effect. To determine tax for the pieces of money at the mercy of lower tax treaty prices, shape the brand new tax for each independent goods cash during the quicker rates you to definitely applies to you to definitely items under the treaty. A full text message from individual taxation treaties is additionally available at Irs.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties-A-to-Z.

If the mailing target is different from their permanent home address (as an example, make use of a good PO mrbetlogin.com web Field), get into your permanent street address. The definition of partner will likely be understand since the gender-natural and you will comes with a person inside the a marriage that have an exact same-sex spouse. For many who fill in the return which have forgotten profiles otherwise lost entries, we simply cannot process it and you may be subject to penalty and attention.

Rent Direction

- Find Dining table one in the new Taxation Treaty Dining tables, offered at Internal revenue service.gov/TreatyTables, to own a listing of taxation treaties you to exempt You.S. personal defense advantages of You.S. tax.

- Married dual-status aliens is claim the financing on condition that they want to file a combined come back, while the discussed within the part step one, or if perhaps it be considered because the particular hitched somebody life style aside.

- All of the rights reserved.Your Area Credit Relationship (YNCU) is an authorized borrowing from the bank connection functioning within the, and you will underneath the laws out of, the newest province from Ontario.

- The partnership offers a statement to your Function 8805 showing the newest tax withheld.

Legislation provides penalties to own inability to file production or shell out taxation as required. You might be required to file information productivity so you can statement certain overseas income otherwise assets, or financial deals. When you are a shareholder inside a shared finance (or any other RIC) or REIT, you can allege a card for your show of any taxation paid off by the business for the their undistributed enough time-term funding growth.

Where you should File

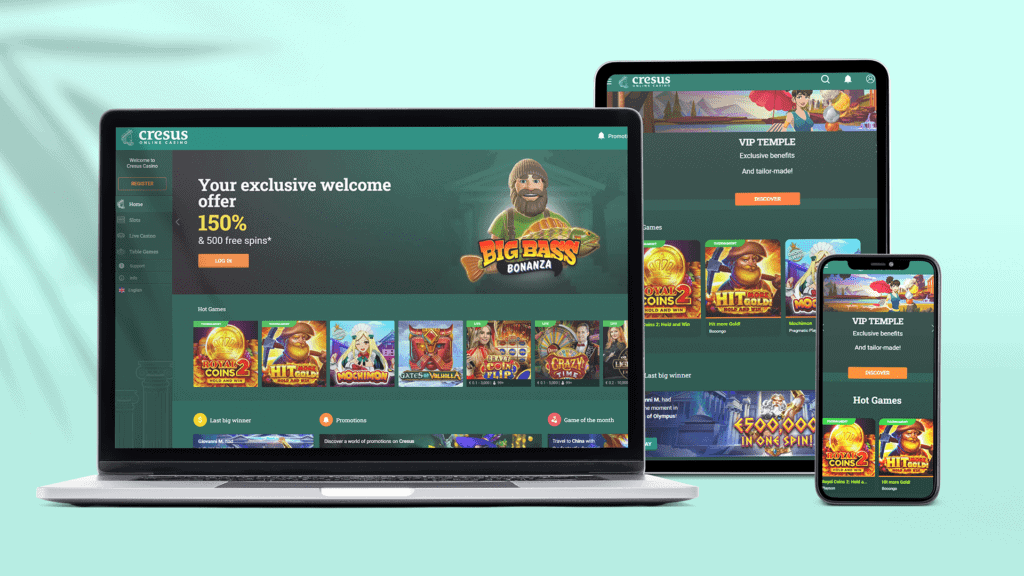

Not many gambling on line internet sites render higher no deposit gambling enterprise bonuses. Not too long ago just about every online casino website transformed on the deposit bonuses otherwise deposit & get possibilities. But not, at BonusFinder we try for the best no deposit bonuses and alternatives.

Range 76 – Child Income tax Borrowing from the bank (YCTC)

Rating form FTB 3805P, Additional Fees to your Accredited Arrangements (and IRAs) and other Tax-Best Profile. If necessary to help you report more tax, declaration it on the web 63 and you may make “FTB 3805P” to the left of your own count. In case your kid is actually hitched/otherwise an enthusiastic RDP, you need to be entitled to claim a centered exclusion borrowing from the bank to have the child. RDPs just who document a ca taxation go back while the married/RDP filing as you and have zero RDP changes ranging from federal and you will California, blend its personal AGIs off their federal taxation statements registered with the brand new Irs. Reference your finished federal income tax return to over which section.

When the satisfied with all the information, the brand new Irs will determine the amount of their tentative income tax to the income tax year to the gross income efficiently regarding your own trading or team in the us. Ordinary and you may necessary team expenses is going to be considered in the event the known to the fresh fulfillment of the Administrator or Commissioner’s subcontract. Nonresident aliens that are bona fide citizens of your You.S Virgin Countries commonly subject to withholding away from U.S. income tax to the money gained while you are temporarily working in the usa.

This procedure applies a daily unexpected rate to the dominant inside the fresh account daily. Rate suggestions – The interest rate in your membership is actually NaN% with a yearly Commission Yield away from NaN. The eye prices and you will yearly fee productivity try variable that will change any moment during the the discernment. Delight keep in mind that once you sign up, unlock a free account, otherwise have fun with our very own features, you invest in getting limited by these terminology. Payments of U.S. taxation should be remitted to your Irs inside the U.S. dollars. Check out Internal revenue service.gov/Repayments for information on how and make a payment playing with one of one’s following the possibilities.

The new landlord also will costs clean up fees in addition reviewed damage can cost you. As the a property manager, protection places render a safety net when you are renting out property. However, the entire process of collecting dumps and you can handling dedicated account can create a requiring workload, prompting of many landlords to take on shelter deposit options one eliminate administrative load. Their platform can also be speed up the brand new formula interesting, upgrade prices for very long-term renters, and ensure direct signal out of accumulated focus to the account statements.